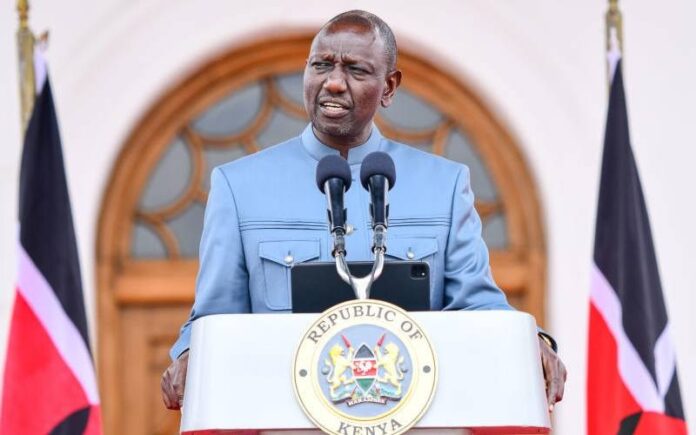

In a move to tackle liquidity challenges and economic hardships exacerbated by the impact of Covid-19, the war in Ukraine, and a severe drought in the Horn of Africa, Kenyan President William Ruto announced on Thursday the government’s plans to privatize 35 state-owned companies.

Additionally, they are contemplating opening up the capital of around 100 other enterprises. The Kenyan economy, historically a powerhouse in East Africa, has faced significant disruptions, with public debt reaching over 10,100 billion shillings, approximately two-thirds of the country’s gross domestic product, by the end of June.

Addressing investors, President Ruto shared that the first batch of 35 companies is earmarked for privatization, with nearly a hundred others under consideration.

The International Monetary Fund (IMF) has recently urged Kenya to reform state-owned entities, particularly highlighting concerns with entities such as Kenya Power and Kenya Airways, both of which reported substantial losses in 2022.

In response to these challenges, President Ruto signed a law last month to facilitate the privatization of public companies, emphasizing the potential for increased efficiency and effectiveness in the private sector.

The IMF has played a role in supporting Kenya, announcing a $938 million loan agreement in November. Furthermore, the World Bank revealed plans to provide $12 billion in support to Kenya over the next three years.

To alleviate the country’s debt burden, President Ruto’s government has proposed a budget that has faced public backlash, leading to protests.

The budget includes new taxes expected to generate 289 billion shillings, supplementing the planned budget of 3,600 billion shillings for the fiscal year 2023-24.

President Ruto expressed the need to unlock the potential of lucrative public enterprises stifled by government bureaucracy, suggesting that the private sector could deliver these services more efficiently.